capital gains tax increase date

Ad The Leading Online Publisher of National and State-specific Legal Documents. The effective date for this increase would be September 13 2021.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

500000 of capital gains on real estate if youre married and filing jointly.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. Establish the date you buy or acquire an asset your share of ownership and records to keep. Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. The maximum rate on long-term capital gains was again.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. The IRS typically allows you to exclude up to. The capital gains tax is based on that profit.

Its the gain you make thats taxed not the. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to 900000 of the deferred gain. Once fully implemented this would mean an effective federal.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it. Youll owe either 0 15 or 20. Check if your assets are subject to CGT exempt or pre-date CGT.

Further penal interest will be levied as well if there are any tax dues. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. With tax writers launching mark-ups as early as Sept.

Assume the Federal capital gains tax rate in 2026 becomes 28. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

The 1987 capital gains tax collections were slightly below 1985. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. How and when CGT is triggered such as when an asset is sold lost or destroyed.

On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with income exceeding 1 million to 396 from the current 20 tax rate. Or sold a home this past year you might be wondering how to avoid tax on capital gains. The announcement of the plan formally kicked off the legislative.

27 deadline there could be imminent action triggering an effective. If we conservatively use October 15 2021 as the effective date of the tax rate increase any tax-advantaged MSR trade would need to have a sale date of 9302021. You do not have to pay capital gains tax.

The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket. 250000 of capital gains on real estate if youre single. Ad If youre one of the millions of Americans who invested in stocks.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

This resulted in a 60 increase in the capital gains tax collected in 1986. President Biden will propose a capital gains tax increase for households making more than 1 million per year. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

Additionally the change to 25 could be effective. The top rate would jump to 396 from 20. By Freddy H.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Filing ITR after the due date belated ITR will invite a late filing fee of up to Rs 5000. 9 and racing against a Sept.

Capital Gains Tax. If an individual misses the due date of filing ITR for FY 2021-22 AY 2022-23 ie July 31 2022 then there are monetary and non-monetary consequences as well. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Long-Term Capital Gains Taxes. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Get Access to the Largest Online Library of Legal Forms for Any State.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

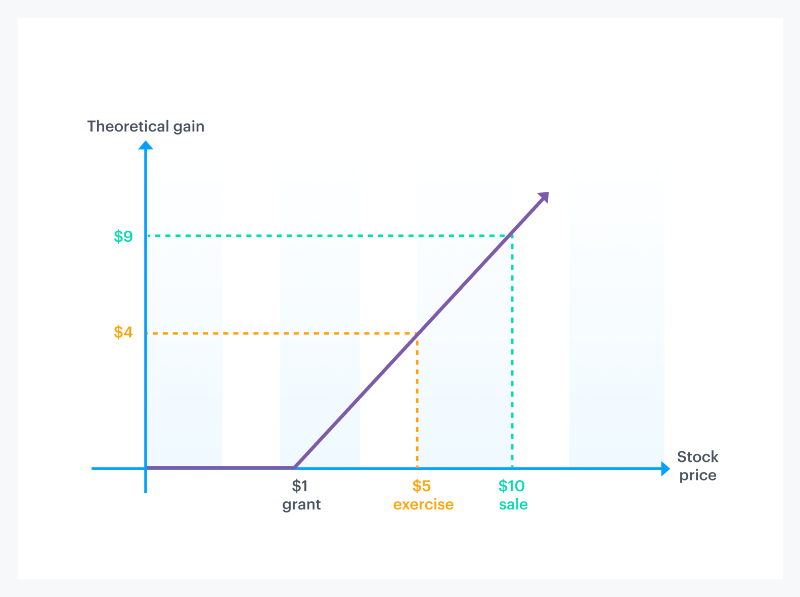

Get The Most Out Of Employee Stock Options

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

2022 Capital Gains Tax Rates By State Smartasset

How Do Taxes Affect Income Inequality Tax Policy Center

When Does Capital Gains Tax Apply Taxact Blog

How Stock Options Are Taxed Carta

Capital Gains Tax What Is It When Do You Pay It

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)